There Is Growing Risk of Violence in Heavily Indebted and Aid-Dependent Countries

As donor countries reduce aid budgets and recipient countries struggle to repay their debt, the risk of economic disruption and social unrest is intensifying. Across the globe, a silent crisis is unfolding in countries where development is heavily financed through loans rather than domestic resources.

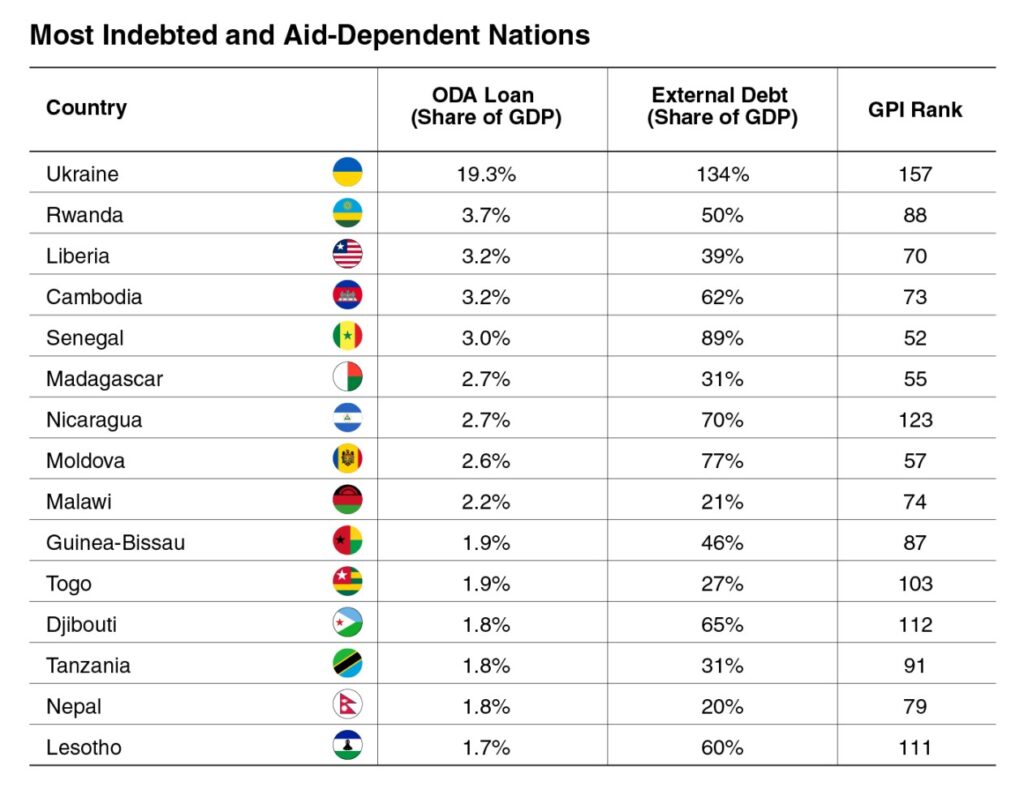

Total Official Development Assistance (ODA) loans nearly doubled between 2014 and 2023, rising from US$38 billion to US$74 billion, according to the latest report from the Institute for Economics & Peace. A growing number of low- and middle-income nations remain critically dependent on these loans. Ukraine stands out with the highest debt, largely due to the extraordinary circumstances it faces in its ongoing three-year war with Russia.

However, African countries are likely to be the most negatively impacted. The recent USAID cuts are predicted to have had devastating consequences. They could potentially reverse decades of progress in health, poverty reduction, and democracy, leading to increased mortality, disease outbreaks, and economic hardship on the continent, where USAID directed about a quarter of its budget.

The UK’s official development aid (ODA) has been slashed from its peak rate of 0.7% to 0.5% and will now be cut to 0.3%.

ODA loans are now central to a mounting financial and political challenge. Although ODA loans are intended to bridge fiscal gaps and support development, several countries demonstrate significant reliance on them. According to the latest report from the Institute for Economics and Peace (IEP), Rwanda, Liberia, Cambodia, and Senegal receive loans equivalent to 3% or more of their GDP. These figures reflect the vulnerability of these economies to sudden changes in aid flows or credit terms.

Compounding this issue, many of these countries also carry high levels of external debt. Without structured and sustainable debt resolution, an inability to meet repayments could spark widespread instability. If grants are cut and loans forgiven without coordinated restructuring, the consequences may be severe. Poorly managed debt cancellation can make future borrowing more difficult and expensive. Creditors tend to be wary of lending to countries with a history of write-offs, especially in the absence of meaningful reform. As a result, financing essential development areas like infrastructure, education, and health becomes increasingly difficult, worsening poverty and fuelling political and social tension.

In some cases, this economic fragility overlaps with an already precarious security environment. Countries such as Nicaragua, Djibouti, and the Democratic Republic of the Congo rely heavily on ODA loans and also rank poorly in the Global Peace Index (GPI). With weak governance and high levels of violence, these nations are particularly susceptible to further destabilisation if foreign funding dries up or becomes harder and more expensive to access.